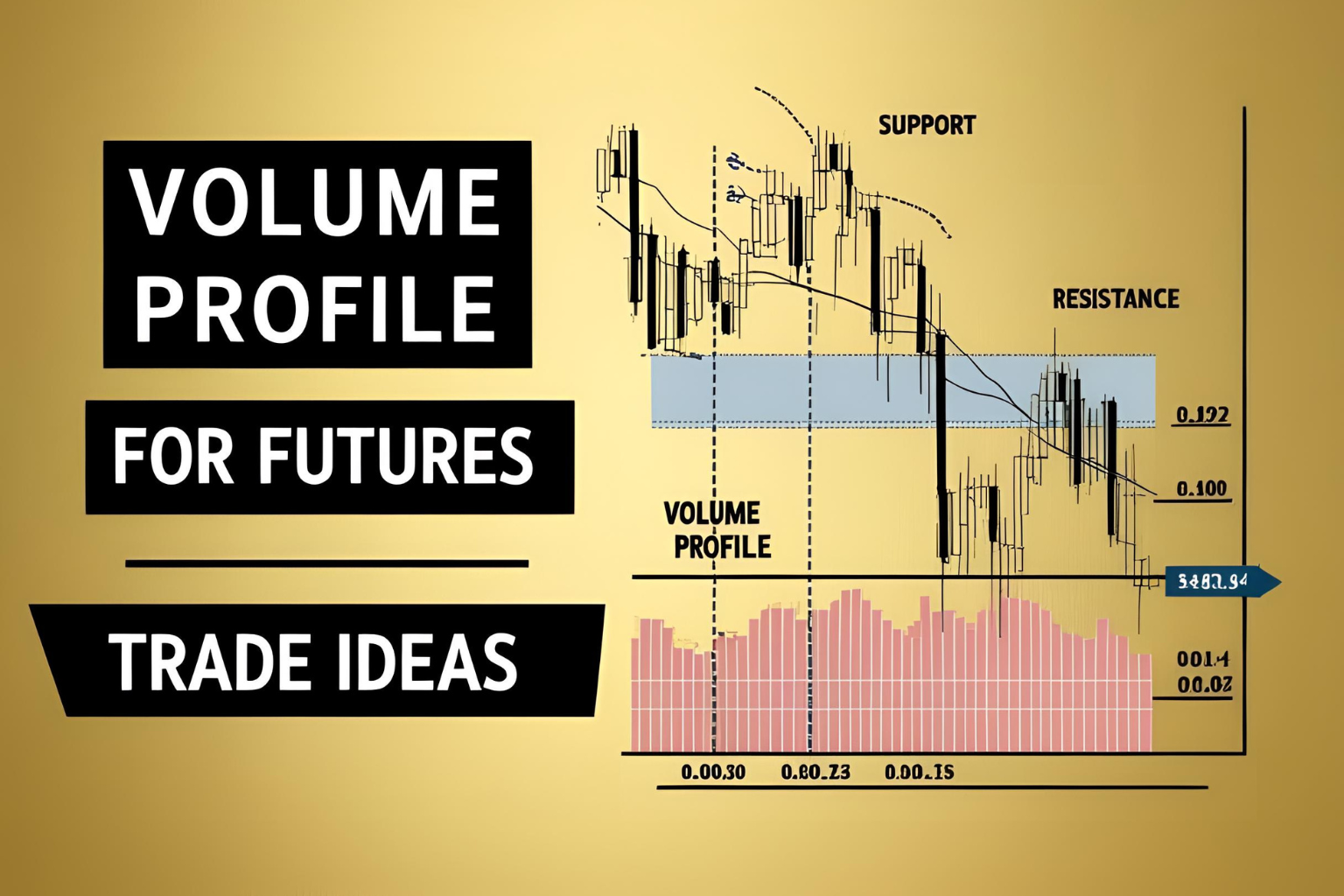

Using Volume Profile for Futures Trade Ideas

The volume profile is a powerful charting tool that shows where the most trading activity occurs at specific price levels. For futures traders—especially beginners—understanding volume profile can help identify high-probability entry and exit zones. In this guide, you’ll learn how to apply volume profile analysis to develop futures trade ideas with more confidence.

What Is Volume Profile?

Volume profile displays the amount of trading volume at each price level rather than over time. It helps you see where the market is accepting or rejecting price, which is crucial in futures markets like E-mini S&P 500 (ES), Nasdaq (NQ), or Crude Oil (CL).

Key Concepts:

- Point of Control (POC): Price level with the highest traded volume

- Value Area (VA): Range that contains ~70% of all volume

- High-Volume Node (HVN): Areas of strong price acceptance

- Low-Volume Node (LVN): Areas of rejection or fast price movement

1. Use POC as a Magnet for Price Reversion Trades

Prices often revert to the Point of Control after extended moves.

Strategy:

- Entry: Enter short or long if price moves away and then returns to the POC.

- Stop-Loss: Above or below recent high/low.

- Target: Mid-value area or next support/resistance level.

Why it works: POC represents the most fair value. Market tends to revisit this level before making its next move.

2. Trade Breakouts at Low-Volume Nodes (LVNs)

Low-volume areas signal a lack of interest—meaning once price breaks into or through an LVN, it often moves quickly.

Strategy:

- Entry: Enter as price breaks through an LVN.

- Stop-Loss: Place on the opposite side of the LVN.

- Target: Next high-volume node or POC.

Tip: Combine with candlestick confirmation or volume spikes for stronger signals.

3. Value Area High and Low Reversals

The Value Area High (VAH) and Value Area Low (VAL) are powerful levels for fade setups.

Strategy:

- Entry: Enter short at VAH or long at VAL when price shows rejection (e.g., wick or engulfing pattern).

- Stop-Loss: Outside the value area.

- Target: Midpoint of the value area or the POC.

Why beginners like it: Clear structure, defined risk, and repeatable behavior.

Platforms That Support Volume Profile

- TradingView (Pro and above)

- ThinkorSwim

- NinjaTrader

- Sierra Chart

- MetaTrader with plugins

Most volume profile tools are available only on premium platforms, but some brokers offer free access.

FAQs

Is volume profile useful for intraday futures trading?

Yes. Many intraday futures traders rely on volume profile to find real-time support, resistance, and trade zones.

How do I add volume profile to my chart?

On platforms like TradingView, use the “Visible Range” volume profile tool under indicators.

What is the best futures market for volume profile trading?

Popular ones include ES (S&P 500), NQ (Nasdaq), CL (Crude Oil), and GC (Gold).

Can I combine volume profile with indicators?

Yes. Combine with RSI, moving averages, or VWAP for confirmation.

Do beginners need volume profile to start trading futures?

It’s not required but highly beneficial once you understand basic price action.