How to Trade Gold Futures with Low Capital

Gold futures are a popular way to speculate on the price of gold, hedge against inflation, or diversify your trading portfolio. However, many beginners think gold futures require large capital. The good news is—you can trade gold futures even with a small account by choosing the right contract size and following low-risk strategies.

In this guide, you’ll learn how to get started with gold futures using low capital and beginner-friendly setups.

Why Trade Gold Futures?

- High Liquidity: Gold is one of the most actively traded commodities.

- Clear Price Movements: Follows technical levels well, ideal for chart-based strategies.

- Multiple Contract Sizes: From standard to micro, making it accessible for all traders.

1. Start with Micro Gold Futures (MGC)

The Micro Gold Futures (MGC) contract on the COMEX allows you to trade gold at 1/10th the size of the standard contract.

Key Info:

- Ticker: MGC

- Contract size: 10 oz

- Lower margin requirement (approx. $800–$1,200 depending on broker)

Why it’s beginner-friendly:

You get exposure to gold without risking a large amount of capital.

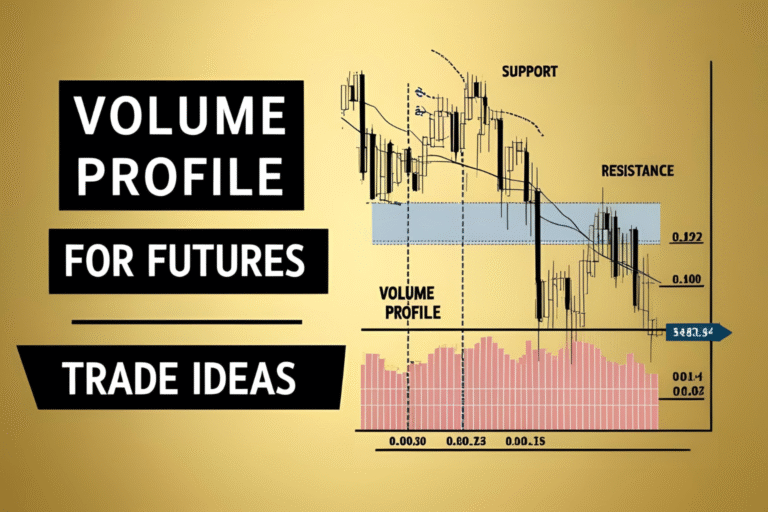

2. Use Support and Resistance on 1-Hour or 4-Hour Charts

Gold futures respect key technical levels, especially around news events like Fed announcements or CPI reports.

Strategy:

- Entry: Buy at support or sell at resistance.

- Stop-Loss: Just below/above the level.

- Target: Next key price zone or round number (e.g., $2,000 or $1,980).

Tip: Use tools like TradingView and mark previous highs/lows to identify trade zones.

3. Apply Moving Averages to Spot Trends

The 21-EMA or 50-SMA works well on gold futures charts to catch trend pullbacks.

Strategy:

- Entry: Enter when gold pulls back to the moving average and shows a bounce or bullish candle.

- Stop-Loss: Slightly below the moving average.

- Target: Recent swing highs or trendline resistance.

4. Avoid High-Volatility Periods Without a Plan

Gold can move rapidly during economic news. Beginners should avoid trading during:

- Fed rate decisions

- Non-farm payroll (NFP) reports

- CPI or inflation data releases

Better approach: Wait until the volatility settles and enter on confirmation.

FAQs

Can I trade gold futures with $1,000?

Yes, with micro gold contracts (MGC), many brokers allow you to trade with $1,000–$1,500 depending on margin requirements.

Is gold a safe market for beginners?

Gold is less volatile than crypto but can still move sharply during news. It’s suitable for beginners with proper risk control.

What’s the best timeframe for gold futures trading?

For low capital traders, use 1-hour or 4-hour charts to avoid overtrading and noise from short-term fluctuations.

Do I need special software to trade gold futures?

Most brokers offer futures platforms like ThinkorSwim, NinjaTrader, or MetaTrader 5 with gold charting capabilities.

What is XAU/USD? Is it the same as gold futures?

XAU/USD is the spot gold price in forex markets, while futures contracts are exchange-traded. Both follow similar technical setups.