Bitcoin Futures Trading: Ideas for New Traders

Bitcoin futures offer an exciting way for traders to gain exposure to crypto price movements without owning the asset. For new traders, Bitcoin futures can seem complex—but with proper strategies and risk control, they provide great short-term and intraday opportunities. This guide covers beginner-friendly trade ideas and essential tips for trading BTC futures safely and effectively.

What Are Bitcoin Futures?

Bitcoin futures are contracts that allow you to buy or sell BTC at a predetermined price in the future. These are cash-settled, traded on platforms like CME or crypto exchanges (e.g., Binance, Bybit).

Key contracts:

- BTC Futures (CME) – Institutional product

- BTCUSDT Perpetual (Binance) – Popular among retail traders

- Micro Bitcoin Futures (MBT) – Great for beginners; 1/10 size of a BTC contract

1. Trade Support and Resistance Zones on 1-Hour Charts

BTC futures often respect clean horizontal zones, especially around round numbers ($25,000, $30,000, etc.).

Strategy:

- Identify a strong support or resistance area

- Entry: Buy on bounce from support or sell on rejection at resistance

- Stop-Loss: Below/above the zone

- Target: Next key level or measured move

Why it works: Bitcoin reacts well to psychological levels and technical structure.

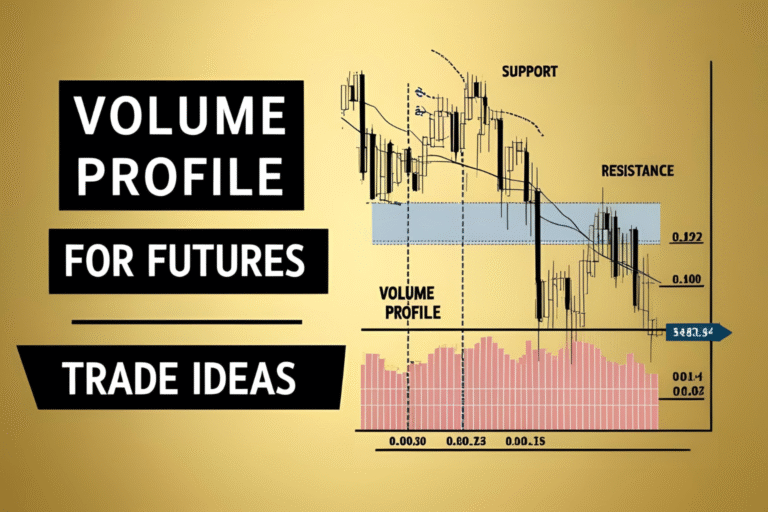

2. Breakout Strategy Around High-Volume Zones

Breakouts often occur after long consolidation or low-volatility periods.

Setup:

- Use volume profile or range boxes to identify tight zones

- Entry: On breakout above resistance (buy) or below support (sell)

- Stop-Loss: Just inside the zone

- Target: Width of the range projected forward

Best Time: During U.S. or Asia market overlap when volume increases

3. Use the 21-EMA for Trend-Based Entries

The 21-Exponential Moving Average works well on BTC 15M and 1H charts for spotting pullbacks.

Strategy:

- Entry: When price pulls back to 21-EMA in a strong trend and forms bullish/bearish candle

- Stop-Loss: Just beyond the EMA or last candle wick

- Target: Recent high/low or trendline

Pro Tip: Combine with RSI > 50 for trend confirmation.

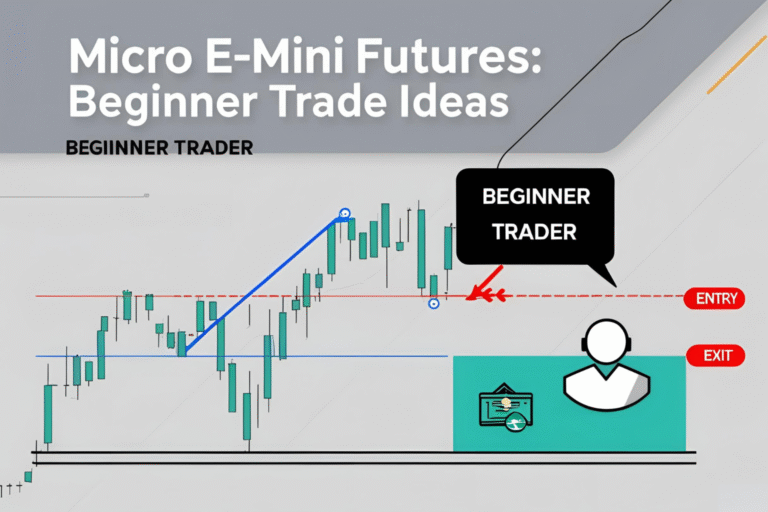

4. Micro BTC Futures for Low-Capital Traders

The MBT (Micro Bitcoin Futures) on CME is 1/10 the size of a full contract—ideal for beginners.

- Lower margin requirements

- Great for practice and position sizing

- Can be used to learn futures structure with less risk

FAQs

Is Bitcoin futures trading safe for beginners?

It can be, if you use proper stop-losses, avoid over-leverage, and stick to defined setups.

What’s the difference between perpetual and dated futures?

Perpetual contracts have no expiry. Traditional BTC futures (like CME) have set expiration dates.

Can I trade Bitcoin futures with $500?

Yes, on platforms like Binance or with CME’s Micro BTC contracts—though margin varies by broker.

Is trading BTC futures better than spot trading?

Futures allow for short-selling, leverage, and intraday strategies—but require strict risk control.

What platforms can I use?

Binance Futures, Bybit, Deribit (crypto exchanges), or CME-linked brokers for regulated trading.