Micro E-mini Futures: Trade Ideas for Beginners

Micro E-mini futures are a game-changer for beginner futures traders. These contracts offer access to major U.S. indices with much lower capital requirements than standard futures. In this guide, we’ll share simple, low-risk trade ideas using Micro E-mini futures—ideal for learning, practicing, and growing as a trader in 2025.

What Are Micro E-mini Futures?

Micro E-minis are smaller-sized versions of the popular E-mini index futures. They trade on the CME and represent 1/10th the size of the standard contracts.

Most popular symbols:

- MES: S&P 500 Micro E-mini

- MNQ: Nasdaq-100 Micro E-mini

- MYM: Dow Jones Micro E-mini

- M2K: Russell 2000 Micro E-mini

Why beginners love them:

- Lower margin requirements (~$100–$200 per contract)

- Ideal for practicing without large risks

- Traded nearly 24 hours a day, 5 days a week

1. Trade Trend Pullbacks with the 21 EMA

Micro E-minis often trend well, making them ideal for pullback strategies.

Strategy:

- Use the 5-minute or 15-minute chart

- Wait for price to pull back to the 21 EMA

- Entry: On bullish/bearish confirmation candle

- Stop-Loss: Below/above the EMA

- Target: Previous swing high/low or risk-reward of 1:2

Best for: MES and MNQ during U.S. session hours (9:30 AM – 11:30 AM EST)

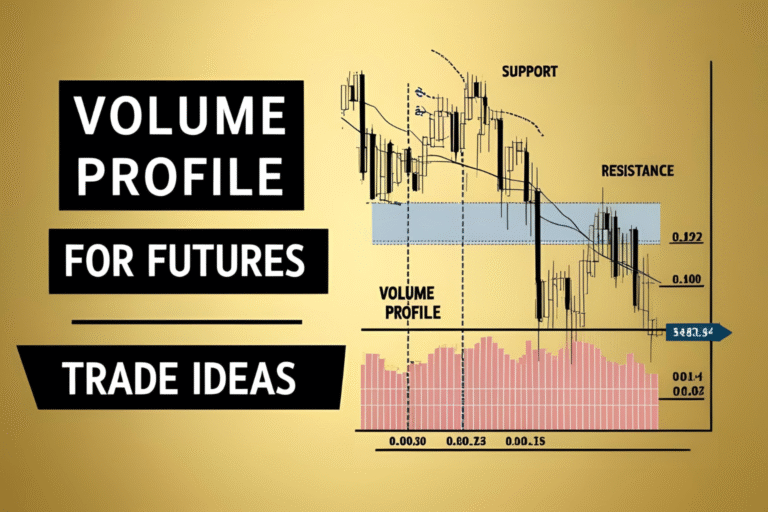

2. Breakout Strategy at Key Support/Resistance

Futures markets often break out after consolidating at clear levels.

Strategy:

- Draw horizontal lines around consolidation zones

- Entry: Enter long above resistance or short below support

- Stop-Loss: Inside the range

- Target: Projected based on the width of the consolidation range

Example: Trade a 10-point range breakout on MES with a 10–15 point target.

3. Opening Range Breakout (ORB) Strategy

The first 15–30 minutes of the U.S. session sets the tone for the day.

Strategy:

- Mark the high and low of the first 15 minutes after the U.S. market opens

- Entry: Buy break above the high or sell break below the low

- Stop-Loss: Inside the range

- Target: 1.5x–2x the opening range

Works well on: MES and MNQ during high-volatility news days

4. Use VWAP for Mean Reversion Trades

The Volume-Weighted Average Price (VWAP) acts as a dynamic magnet for price in intraday trading.

Strategy:

- Fade (trade against) extended moves away from VWAP

- Enter short when price is extended above VWAP + showing weakness

- Enter long when price is far below VWAP + showing bounce

Tip: Use only during low-news periods for stable price action.

FAQs

How much money do I need to trade Micro E-minis?

You can start with as little as $500–$1,000, but always follow proper risk management and avoid over-leveraging.

Are Micro E-mini futures good for beginners?

Yes. They offer low exposure, high liquidity, and the chance to trade real markets with less capital at risk.

What’s the best Micro E-mini for beginners?

MES (S&P 500) is the most stable and widely traded, making it ideal for learning.

Do I need special software to trade futures?

Platforms like NinjaTrader, ThinkorSwim, and TradingView (for charting) work well. Most brokers provide access to futures trading platforms.

Can I use stop-losses with Micro E-minis?

Absolutely—and you should. Futures are leveraged, so stop-losses are essential.