Top 3 Stock Trade Ideas for Beginners in 2025

Starting your journey in the stock market can feel overwhelming, especially with hundreds of companies to choose from. In this guide, we break down three beginner-friendly stock trade ideas for 2025—each selected for their growth potential, ease of analysis, and relevance to U.S. markets. These ideas are designed to help you build confidence and develop your trading skills step by step.

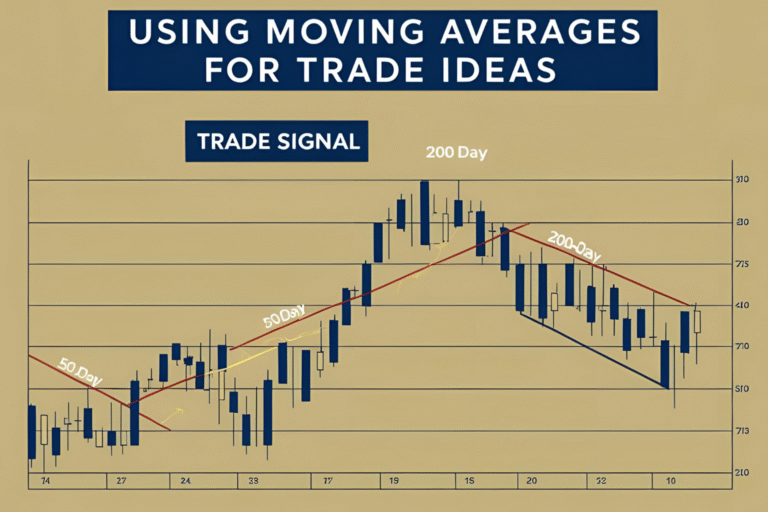

1. Buy Microsoft (MSFT) on a Pullback to the 50-Day Moving Average

Microsoft continues to be a stable performer with consistent earnings, a strong AI presence, and long-term growth. In 2025, buying MSFT on dips toward its 50-day moving average (50-DMA) presents a low-risk, high-probability trade setup.

Strategy:

- Entry: Buy when MSFT pulls back and bounces off the 50-DMA.

- Stop-Loss: Place below the recent swing low.

- Target: Prior high or next resistance level.

Why it works: The 50-DMA often acts as dynamic support for trending stocks like Microsoft, making it a reliable area for entries.

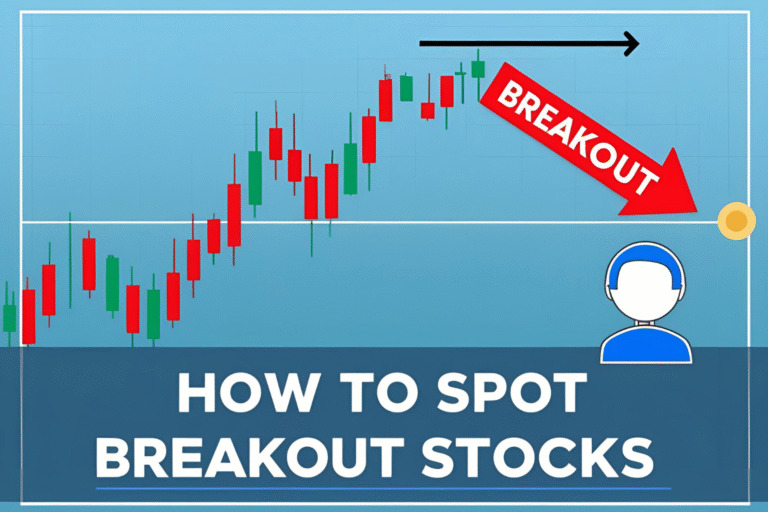

2. Swing Trade Tesla (TSLA) on Breakout Above Resistance

Tesla remains a popular stock with high volume and frequent swing trading opportunities. A clean breakout above well-defined resistance can signal the start of a new bullish phase.

Strategy:

- Entry: Buy when TSLA breaks above a resistance level on strong volume.

- Stop-Loss: Just below the breakout level.

- Target: Measure the height of the previous range and project upward.

Tip: Use TradingView to plot horizontal resistance and monitor volume spikes on breakout days.

3. Invest in SPY ETF for Long-Term Growth

For new traders who want exposure to the overall market without picking individual stocks, the SPDR S&P 500 ETF (SPY) is an ideal choice.

Strategy:

- Entry: Use dollar-cost averaging (DCA) to invest over time.

- Stop-Loss: Not typically used for long-term positions, but monitor the 200-day MA for trend direction.

- Target: Hold for long-term appreciation and dividends.

Why it’s beginner-friendly: SPY gives you diversification across 500 top U.S. companies, reducing single-stock risk while allowing for long-term growth.

FAQs

What is the best stock to trade for beginners in 2025?

Microsoft (MSFT) and SPY ETF are solid options due to their stability, liquidity, and strong fundamentals.

How much money do I need to start stock trading?

You can begin with as little as $100–$500 using fractional shares and a commission-free broker.

Is swing trading safe for beginners?

Yes, when combined with proper risk management and clear entry/exit rules.

What’s the difference between ETFs like SPY and individual stocks?

ETFs offer diversification, while individual stocks can offer higher returns—but with more risk.

Should I use indicators like moving averages?

Yes. Tools like the 50-day and 200-day moving averages help identify trends and entry points.